Net prices are the standard in many industries. They are easy to communicate and straightforward for sales teams to implement. Customers also appreciate net prices because they create clarity: the price is fixed, bonus settlements are eliminated, and purchasing departments can work more efficiently—for example by directly comparing offers via procurement platforms such as those used by VW. However, a closer look reveals that net prices without a clear system can lead to major inconsistencies and a waste of profit potential.

Net Prices: Simple, but Problematic

In many companies, net prices are not assigned according to a consistent logic. A lack of clear price architecture and systematic approach leads to three central issues:

-

There is no incentive effect, as customers have no motivation to develop their behavior in line with the company’s interests. More efficient ordering processes or the purchase of a broader assortment are not rewarded, since the net price is fixed and customer behavior becomes irrelevant.

-

Pricing depends heavily on negotiation power and the individual skills of sales representatives, which can result in inconsistent price structures.

-

Transparency and traceability are lacking: it is often unclear how individual prices were determined. Insufficient documentation of price negotiations means that some customers pay unchanged prices for years because pricing decisions are neither reviewed nor adjusted.

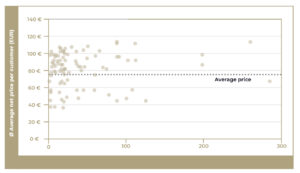

Net Prices in Practice: An Inconsistent Picture

The lack of a systematic approach to net pricing often results in significant price differences between similar customers. These differences are not only difficult to explain, but can also pose long-term risks to business success. Customer-side consolidation and increasing competitive pressure make such discrepancies more visible and more vulnerable to challenge. At the same time, profit potential remains untapped because pricing decisions are not made strategically.

A common attempt to address this issue is to correct net prices that are too low by introducing minimum margins. However, for companies aiming to successfully implement value pricing and value selling, this approach is problematic, as it shifts the focus to price alone rather than value—both in customer communication and internally.

Target Pricing System: A Systematic Solution

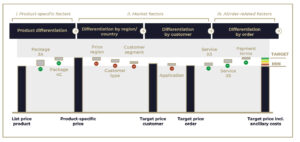

Net prices can work—but only if they are derived systematically. A proven solution is the target pricing system. Target prices can be derived either from list prices or based on costs. While cost-based approaches take actual expenses into account, aligning target prices with list prices offers decisive advantages: it creates a market-oriented price architecture and avoids dependencies on potentially inconsistent internal cost structures.

Regardless of whether target prices are derived from costs or list prices, they are determined using internally objective and transparent criteria such as customer size, segment, assortment breadth, logistical efficiency, or the assumption of additional services.

This system creates transparency and consistency by clearly showing internally why a customer receives a specific price and which factors influence it.

A target pricing system offers several advantages:

-

Simplified controlling: Target prices provide clarity by making deviations transparent and easier to track. Margin losses can be identified early and countermeasures taken proactively.

-

Improved customer communication: Companies can clearly communicate what customers need to do to achieve better net prices—for example by purchasing a broader product range or taking on marketing activities. This helps avoid pricing inconsistencies between comparable customers.

-

Reduced dependence on negotiations: Price negotiations shift away from pure numbers toward clearly defined criteria. Instead of relying primarily on the negotiation skills of sales staff, they are equipped with solid arguments to enforce net prices.

-

Support for strategic objectives: Target prices allow pricing to be used deliberately to achieve strategic goals, such as growth in specific segments or winning large-volume contracts.

Conclusion: Net Prices with a System

Net prices are not the problem—their unsystematic implementation is. A target pricing system provides the solution by ensuring that prices are derived transparently, consistently, and strategically. The result is a pricing approach that creates consistency and transparency, offers customers clear incentives to develop in line with the company’s strategic interests, and simplifies both controlling and internal and external communication.

Moreover, it supports long-term corporate objectives such as targeted growth or increased profitability. Companies that work systematically with net prices do not merely focus on efficiency—they use pricing as a strategic lever for sustainable success.

Kai Pastuch

Managing Partner