In many international companies, net prices form the basis of pricing. They are easy to implement, create clarity, and facilitate comparability. However, this is also where the major weakness lies: unsystematically defined net prices quickly lead to significant inconsistencies—within individual markets and, above all, across national borders. In addition to systematically deriving net prices via a target pricing system, a gross-to-net system can also provide a solution by structurally deriving price levels from list prices. The result is a harmonized price architecture that strengthens margins, preserves local flexibility, and minimizes conflicts of objectives in international pricing.

Challenges in International Pricing

International pricing comes with specific conflicts of objectives, particularly between headquarters and local subsidiaries. Due to their historical development, these subsidiaries often operate independently in price management. As long as local entities achieve their margin and revenue targets, existing pricing processes are rarely questioned, and little effort is made to establish overarching pricing structures.

These unmanaged pricing approaches not only leave profit potential untapped but also lead to customer dissatisfaction. This is particularly evident among international customers with centralized buying centers and purchasing alliances that compare prices across borders. The trend toward international procurement is further reinforced by market consolidation. Large price discrepancies are difficult to justify, lead to renegotiations and dissatisfaction, and increase margin pressure.

In addition to these “external” effects, internal transfer pricing can also create imbalances: products may either arrive at subsidiaries at prices that are “too high,” resulting in high end-customer prices and lost sales volumes, or they may be priced too low, effectively giving away profits.

Whether companies are “only” sacrificing profit or actually jeopardizing customer relationships, they often react to such situations rather than proactively managing their international price structures.

How Gross-to-Net Pricing Solves These Issues

A gross-to-net system can also provide relief as an alternative to a target pricing system for net prices (you can read more about target pricing systems in our article “The Problem with Net Prices and How They Work Properly”), by transferring existing prices into an internationally aligned pricing logic. The goal of this international logic is by no means to introduce uniform prices; rather, the objective is a flexible yet coordinated and effectively controllable framework. The process can be divided into three steps to ensure a structured and sustainable implementation:

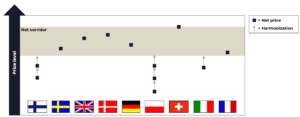

Step One: Harmonizing Net Prices

The first step involves analyzing international net prices and identifying inconsistencies in the pricing structure. Net prices that are clearly too low should be increased directly to realize short-term profit potential. Very large deviations can also be corrected through a multi-stage process to avoid overburdening local markets. The key is to address the most significant flaws in the price architecture and bring the net prices of the various subsidiaries into alignment over the long term. This approach lays the foundation for a consistent pricing logic without overriding local entities.

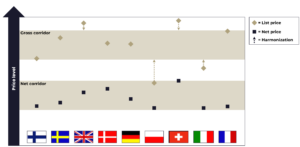

Step Two: Harmonizing Gross Prices

The second step focuses on harmonizing gross prices. List prices, which serve as the starting point for pricing, are aligned internationally to create a consistent and transparent price structure. The aim is to harmonize price levels across regions without necessarily enforcing absolute uniformity. Instead, the goal is to define explainable and customer-comprehensible corridors.

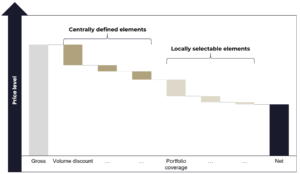

Step Three: Introducing a Joint Price Waterfall

Once price levels have been harmonized and fall within the defined price corridors, an international price waterfall can be introduced that combines centralized control with local adjustments. A shared toolkit of elements forms the foundation: some components, such as service discounts or logistics surcharges, are defined by headquarters and apply internationally. Other elements can be selected individually by each subsidiary and varied in magnitude to best meet local market needs.

This ensures the necessary flexibility: while pure revenue generation may play a decisive role in Portugal, leading to higher discounts, assortment breadth might be the strongest driver in Denmark. In this way, subsidiaries can invest specifically in the factors that are established in their markets and promise the greatest success—without violating the overarching pricing logic.

Benefits of the Gross-to-Net Approach

Introducing a gross-to-net system offers internationally operating companies a wide range of benefits that promote both internal transparency and profitability. One of the key strengths lies in the harmonized pricing structure: international price comparisons become comprehensible without sacrificing necessary local differentiation. At the same time, step-by-step harmonization unlocks unused margin potential and establishes consistent price levels, contributing to sustainable profitability growth.

Another advantage is the reduction of conflicts of objectives between headquarters and local subsidiaries. While clear guidelines are set by the central organization, local entities retain the flexibility needed to serve their markets efficiently and address specific local requirements.

Customer communication also improves significantly: international price differences can be explained transparently, shifting negotiations away from pure price discussions toward value-based criteria. This creates clarity for both sides and strengthens customer relationships.

Finally, optimized steering by headquarters provides a better overview of global price development. Clear governance structures make it possible to align local and global objectives and manage the international pricing strategy more systematically.

Conclusion: Harmonization Without Sacrificing Flexibility

A gross-to-net system creates an internationally harmonized pricing logic that unlocks margin potential and increases transparency, while maintaining flexibility for local adaptations to address specific market needs.

Through a clearly defined framework for gross and net prices combined with a flexible conditions system, international conflicts of objectives between headquarters and local subsidiaries can be resolved.

Kai Pastuch

Managing Partner

Tim Güth

Project Manager